Bill Gross, founder and MD of PIMCO - the biggest bond fund in the world - released his always prescient Investment Outlook for November this week. While he goes into much detail of prospects for US bond investors, his conclusion is the same as ours, voiced in freeman’s post of yesterday: Almost all interest rates – globally - are compressed.

“If policy rates are artificially low then bond investors should recognize that artificial buyers of notes and bonds (quantitative easing programs and Chinese currency fixing) have compressed almost all interest rates.”

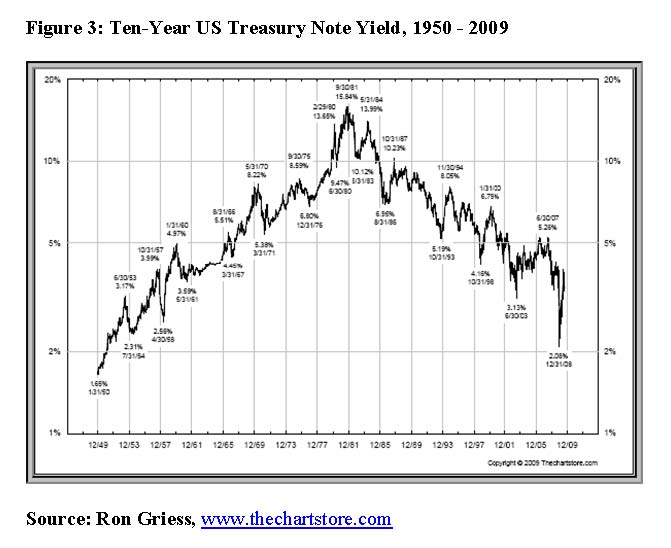

Whichever way one tries to spin the reality, the prospects for government debt prices remain grim. Rising LT bond yields will come back to bite the global economy when least expected, pushing up interest costs of massive global deficits and debt substantially within the next seven years. Long-term interest rates cannot be kept artificially low for a long period of time. It is our opinion that US treasury yields made a climatic low in December 2008 after a 28-year bull market in treasuries (see chart below). Efforts made by governments through QE programmes will not stop the LT trend toward higher yields (the bear market in treasuries), and interfering here by printing money to buy the debt to artificially prop up asset markets will only exacerbate problems over the long-term. South Africa, a debtor nation, on a path of having to borrow 12% of GDP in 2009/10 and similar levels over the next five years, will see a doubling in total public debt, and will not be spared the consequences of an eventual spike higher in long term interest rates of major debtor nations – a weaker currency (relative to precious metals), rising borrowing costs and further pressure on deficits.

After a 28-year bull market in US Treasuries, the trend is now weaker and QE won't stop it.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_zaoz_2.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-zar-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-euro-small.gif)