It’s the eleventh hour and way past time for objections and nay saying as South Africa stands on the doorstep of a massive month-long party in June/July 2010. The FIFA World Cup is coming to town and nothing will stop it. The world will be watching South Africa and I’m sure we’ll put on a good show.

It’s the eleventh hour and way past time for objections and nay saying as South Africa stands on the doorstep of a massive month-long party in June/July 2010. The FIFA World Cup is coming to town and nothing will stop it. The world will be watching South Africa and I’m sure we’ll put on a good show.

It’ll be fun. It’ll be dramatic. It’ll be a once in a lifetime experience. But let’s get one thing straight: The world cup won’t make money.

It’s a party that needs to be paid for, not an economic benefit. The world-cup-will-boost-economic-growth-and-development shtick is straight out of the fallacious Keynesian playbook and, to be honest, is getting tired. Spend money on stadia and…KAZAAM!…the magic multiplier does the rest.

In an official paper on the FIFA World Cup the SA government says that “the hosting of the 2010 World Cup will be a catalyst for faster economic growth and the achievement of development goals.” The state goes on to say that “being the 2010 host will give the country a significant boost towards its target growth rate of at least 6% by 2010.”

A Grant Thornton study then went on to ‘show’ that the World Cup will add about R50 billion to GDP over the 2006-2010 period. Adjusting for 2006 prices that number is about R65 billion in today’s terms. GT estimated that GDP would be boosted by R20 billion due to tourism alone, presumably accruing in 2010. The remaining R45 billion is presumably spread over all four and half years from the start of 2006 until the world cup in mid-2010. That’s about another R5 billion added to GDP in 2010 from construction and related investment stimulus. So that’s about R25 billion added to GDP in 2010 alone due to the world cup, which immediately tacks a full 1 percentage point on top of whatever GDP growth would have been achieved.

The problem with all this soccer-GDP optimism is that it does not stand up to any logical, sound economic scrutiny. The real facts are not as grand as Grant Thornton or the government would like to have you believe.

Reincarnate Fallacies

Chiefly, economic impact studies by supposed ‘expert’ consultants almost never include even a rough attempt at opportunity cost accounting, so claimed benefits are not offset by the forgone benefits associated with allocating capital toward building soccer stadia and away from any other productive investment that could be undertaken.

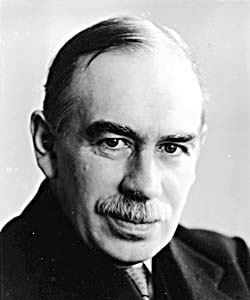

J.M Keynes

Perhaps just as fraudulent however is the application of the Keynesian multiplier in most modern economic impact studies. Keynes and his disciples erroneously postulated that an ‘autonomous’ act of investment spending created income for contractors and suppliers who in turn spent that income (after tax and savings) on other goods and services, providing another set of contractors and shop keepers with income, who in turn spent that income (after another round of tax and savings) on other goods and services, and on and on until the after-tax after-savings income reached zero at the margin. Keynes called this process the spending or income multiplier and estimated it to typically be, depending on the extent of various ‘leakages’ such imports, around 1.5-1.7.

I other words, a R1 billion act of investment spending, or even tourist spending, should, according to Keynes, create R1.7 billion of additional GDP.

Sounds wonderful doesn’t it? Almost magical? Can you spot the fallacy?

Alas, ‘tis too good to be true. Keynes’ multiplier is myth, and one of the most audaciously fallacious and insidious of all economic untruths.

In reality Keynes’ multiplier is nothing more than a glossy impostor, a modern incarnation of millennia-old fallacies revived for each new gullible generation by opportunists with fanciful, grandiose notions of how prosperity can be created by spending and consumption.

An already aged Fred Hayek even commented on this in the 1970’s, bemused at how Keynes managed to revive an idea that had once again been so soundly refuted in the 1800’s, and how it was gobbled up so eagerly by almost everyone, and especially the governing elite.

But a random act of spending does not create wealth any more than a pot of gold at the end of the rainbow is the antidote to a life of toil. On a purely common sense basis the GDP multiplier doesn’t stack up with even the most basic understanding of reality. But, even technically, the idea quickly runs into a host of insurmountable difficulties.

Real vs False Wealth Creation

A detailed technical discussion of this fallacy can be found here (well worth the read) and is beyond the scope of this post, suffice it to say simply that any investment spending must come from saved, borrowed (originally savings), or printed money. Whatever is saved or borrowed for investment must first come from an act of production, which is really where the real wealth was formed. Every other act of spending from the initial borrowed expenditure is simply leveraging off and using up the wealth/capital that was original generated. New wealth is not magically created simply because money, a medium of exchange, is changing hands. Further, if investment funds are printed out of thin air they are not backed by any initial act of real production, and as such the demand is artificial and cannot contribute to overall economic growth.

This is to say nothing of the fact that any borrowing of funds simply crowds out whatever other productive investment could have taken place – back to our earlier argument of the opportunity cost of limited systemic capital. Printing money has the same effect of crowding out investment, because the key to investment spending is not money but saved capital. Printing money only diminishes the incentive to save real capital and so actually diminishes real investment. State investment expenditure funded by taxes runs into the same theoretical hurdles by diverting real capital away from other productive endeavours.

The Grant Thornton study on the GDP impact of the World Cup and the unquestioning gullibility of government and business to buy such nonsense is an indictment on sound economic logic and, worse, another posthumous victory for Keynesian nonsense.

The official stats paint a more realistic picture of the wealth building process. From 2001 to 2008 South Africa’s capital stock rose in real terms by R577 billion (2005 prices). Real GDP over the same period only rose about R450 billion. Keynesian multiplier theory suggests that GDP should have increased by about R865 billion on the back of all that investment spending, more than double than it actually did. Another way of saying it is that real GDP increased by about 36% from 2001-2008. Stripping out employment growth plus meagre growth in labour productivity over this period shaves about 14% off this figure, leaving around 22% attributable to capital, roughly the same magnitude of the capital stock growth over that period.

So, at best we can say that in South Africa for the past decade or so a 1% increase in the capital stock raises the size of GDP by 1%, but based on the rand values it looks like a R1 increase in the capital stock only increases GDP by about R0.80.

To make a case that the FIFA World Cup is growth positive you would have to show that a soccer stadium can generate more GDP for every rand invested to build it than could be generated from investing in any other productive asset. In other words, you have to show that building stadia and upgrading transport networks around stadia is the best use of productive capital. Here’s the quick answer: It isn’t, especially not stadia built in remotesvilles like Rustenburg, Polokwane, and Nelspruit, or built next to perfectly good recreational sporting capital such as in Durban. (remember, the overall transport network upgrade isn’t related to the World Cup and could be undertaken at any stage regardless of the tournament).

The World Cup should be called what it really is. Not a growth generating bonanza but an expensive fiesta. The World Cup if anything is growth negative, especially in a developing country where the return on genuinely productive capital is high.

There’s nothing wrong with partying, but let’s not kid ourselves into thinking the party will make us money.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_zaoz_2.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-zar-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-euro-small.gif)