Economic Boom-Bust cycles (or Business cycles as they have come to be known) have perplexed most economists for decades, so much so that the economic explanations of the issue have effectively been tritely distilled down to “greed”, “irrational exuberance”, or “just a natural human cycle”. Of course all these explanations are complete bunk, and a group of theorists have been pointing this out for decades. Mainstream economists, sadly, pay little attention.

Economic Boom-Bust cycles (or Business cycles as they have come to be known) have perplexed most economists for decades, so much so that the economic explanations of the issue have effectively been tritely distilled down to “greed”, “irrational exuberance”, or “just a natural human cycle”. Of course all these explanations are complete bunk, and a group of theorists have been pointing this out for decades. Mainstream economists, sadly, pay little attention.

Boom-Bust cycles are no accident of greedy and irrational “animal spirits” (Keynes) or an unavoidable part of human nature. Instead they are easy to define, diagnose and remedy. There is no inevitability to Boom-Bust cycles, and, contrary to the popular narrative (especially by many on the right), they are not the ‘unfortunate’ by product of an otherwise very useful and efficient ‘capitalist’ system.

The Boom-Bust cycle is as avoidable as an offensive war, and as much created and perpetuated by governments and central banks as tax policy or money printing.

Back when Nobel prizes meant something, Friedrich von Hayek won the 1974 Nobel Prize for economics for his work on demystifying, diagnosing and remedying the Business cycle which for decades had proven (and remain) disruptive to global economies. Margaret Thatcher even personally consulted with Hayek on economic issues in the 1970’s and some of his work formed the foundation of her economic policies. It is a pity that mainstream economists and governments did not have the same appreciation for Hayek’s work as the Iron Lady did.

A pity, but not a surprise, for Hayek’s work at its core struck at the heart of the socialist-interventionist-statist mindset in which the governing, central banking, commercial banking and mainstream intellectual class is so heavily invested. Hayek’s work on the Boom-Bust, or Business cycle, is a mortal wound for large government interventionism, central bank monetary manipulation, and ivy-league style liberal socialism. In short, Hayek’s theories never had a chance.

Hayek, an Austrian by birth, drawing also on the work of the great Austrian economist Ludwig Von Mises as well the broader Austrian economic tradition, developed a brilliant view of business cycles in which an expansion of money and credit out of thin air by commercial and central banks forces interest rates artificially low and creates an unsustainable investment boom. This must eventually come to an end in a process involving economic dislocation, asset liquidation and deflation as the production structure readjusts to a normal and sustainable pattern. The volatile business cycles are remedied when capital and credit allocation is market-driven and based on the underlying real demand and supply of loanable (saved) funds and society’s preference for saving and consumption as expressed through a market-determined interest rate.

We recommend everyone read Hayek’s compiled works on the Business Cycle in the book, Prices and Production, which can be purchased here.

Joseph Salerno pens the introduction to the book. It is kindly reproduced by the Mises Institute here and is worth the read.

MUST READ: Thomas E. Woods has a brilliant exposition of the Business Cycle Theory also kindly reproduced over at the Mises Institute called, The Forgotten Depression of 1920. (NB: this must be one of the best short essays I’ve read on the subject and is a major indictment on current economic policy being to followed to try “fix” the global economy; highly recommended read)

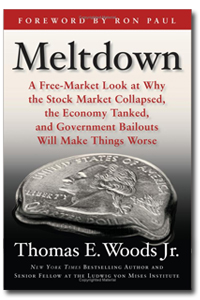

Human Action readers should also consider Woods’ latest book on the current global financial crisis, Meltdown: A Free-Market Look at Why the Stock Market Collapsed, the Economy Tanked, and Government Bailouts Will Make Things Worse. This is an indispensable part of understanding the real problems of our “mixed economy” system of central monetary control and why state and central bank intervention will lead to further economic ruin.

Human Action readers should also consider Woods’ latest book on the current global financial crisis, Meltdown: A Free-Market Look at Why the Stock Market Collapsed, the Economy Tanked, and Government Bailouts Will Make Things Worse. This is an indispensable part of understanding the real problems of our “mixed economy” system of central monetary control and why state and central bank intervention will lead to further economic ruin.

Happy reading.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_zaoz_2.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-zar-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-euro-small.gif)

It is hearting to see their how many Austrians are around today. I have only taken up economics recently; it perplexes me why anybody would not be an Austrian?? Anyway thanks for running a great site!

It’s a pleasure. Hope you enjoy what we have to say…